Consumer sentiment declined modestly in April

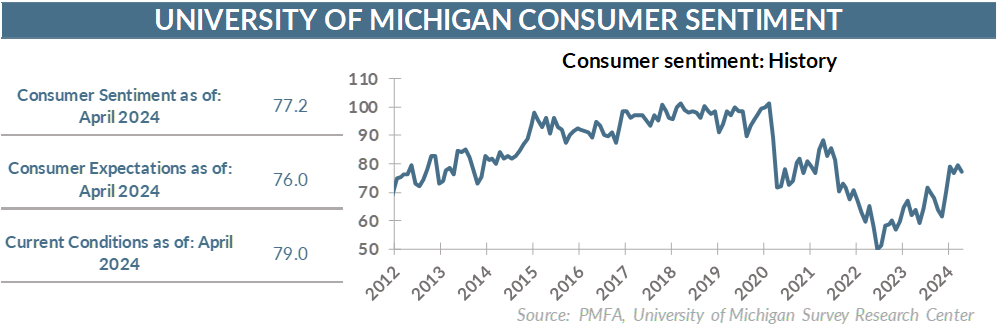

“Steady as she goes” might be the best descriptor of the collective consumer mood in recent months. The April iteration of the University of Michigan’s Index of Consumer Sentiment largely confirmed that, showing very little change from the prior month. The index declined modestly from 79.4 in March to 77.2 in the revised April reading, a slight step down that’s not enough to suggest a statistically meaningful change. While subtle shifts have occurred under the surface across different age bands and political affiliation, there’s been relatively little movement in consumer attitudes overall in recent months.

Underlying the dip in the overall index were corresponding declines in survey respondents’ assessments of current economic conditions and the outlook for later this year, both of which dimmed modestly. Conversely, both near- and long-term inflation expectations edged up, breaching the 3.0% threshold. That’s notable, given the steep decline in actual inflation gauges since 2022. Since last fall, various measures of consumer inflation have become stickier and rangebound well above both the Fed’s 2% goal and the sub-2% range that consumers were accustomed to over the decade leading up to the pandemic.

Inflation may no longer be a source of pain to the degree that it was a few years ago, but it’s certainly still a source of discomfort.

On a brighter note, consumers are notably more upbeat in their assessment of the economy than was the case a year ago. Talk of recession has faded significantly as growth surprised to the upside in the latter half of last year. Even as economic momentum and household consumption growth have slowed this year, household balance sheets remain generally solid. Robust labor conditions and solid wage growth have been sources of reassurance for households that remain frustrated by elevated inflation.

Improvement in the inflation picture through much of 2023 and the Fed’s decision to hold steady on short-term interest rates last fall were key catalysts for improved confidence. The fact that the economy was still growing in 2022 as sentiment readings collapsed to a range normally seen during recessions was telling of how painful surging prices were for the average household.

Recession fears have abated for now, but inflation remains a key concern for consumers and one for which the outlook remains mixed. Inflation has receded significantly since peaking but has been stuck in a comparatively narrow range by most measures since last fall.

Beyond the downside surprise for growth in yesterday’s GDP report, the key measures of inflation within the report moved in the wrong direction. Even a modest resurgence in inflation could spook consumers, potentially further delay potential Fed rate cuts, or put the possibility of some additional tightening back on the table.

What will this mean for spending? That may also be a mixed bag, as households still appear a bit more willing to spend more freely on services, while remaining a bit more constrained on goods consumption. For the latter, it’s likely that higher interest rates are playing a role, creating an additional cost hurdle for consumers contemplating purchases on higher-ticket items that might require financing.

Subdued sentiment also likely reflects the growing focus on the November election and the large and growing political and social divide that’s creating angst for voters on both sides. Historically speaking, elections have generally had little impact on the contours of the economy though and this one isn’t likely to significantly influence households’ propensity to spend.

The bottom line? Although a return to that environment appears unlikely, consumers haven’t fully adapted to the current higher-inflation, higher-interest rate environment. Both should recede in due time. For now, it still appears to be an issue of when, not if. The fact that the “when” keeps getting pushed back remains a significant “gray” lining on what’s otherwise in many ways a good environment for consumers.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.